Unlock growth without owning assets.

Lease smarter, save more.

The prospective lessee selects the machinery / equipment and finds the supplier and negotiates the price. Why? Because the lessee has superior understanding of the technical requirements of the asset.

Lease Mandate from Lessee is obtained, wherein the negotiated terms are captured. We execute the Master Rental Agreement with the Lessee which captures the essential terms and conditions of the lease.

The Lessee is requested to submit audited financials and basis the credit assessment, the facility amount is sanctioned.

Once the Equipment is delivered, the lessee acknowledges the same and signs the rental schedule. On receipt of rental schedule and other necessary documents pertaining to the equipment delivery, the payments are promptly released to the vendor.

The lessee makes rental payments as per the terms of the rental schedules and continues to use the assets for the rental term. At the end of the term the Lessee enjoys the flexibility to return, re-rent or retain by purchasing the assets.

Access the right equipment, right when you need it.

Operations Lease Financing can help you maintain cash flow while making necessary improvements to your business or purchasing the equipment you need for efficient operations.

You can apply for Operations Lease Financing through our platform. We recommend contacting us for detailed instructions.

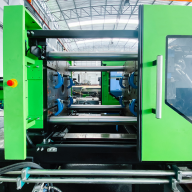

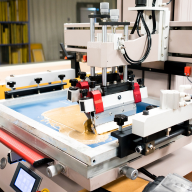

You can use Operations Lease Financing for a wide range of needs, including refurbishing commercial premises (Fitout Finance) or financing capital expenditures on machinery (Capex/ Machine Finance).

Check your Eligibility & Book a Free Consultation with RFin.

Fill out the form below and we will contact you as soon as possible.